The temporary payroll tax deferral went into effect on Sept. 1, but that doesn’t necessarily mean you’re going to see more money in your paychecks this month. Some companies are opting out of the deferral because they’re worried employees will be burdened with footing double the tax bill after the first of the year to pay it back.

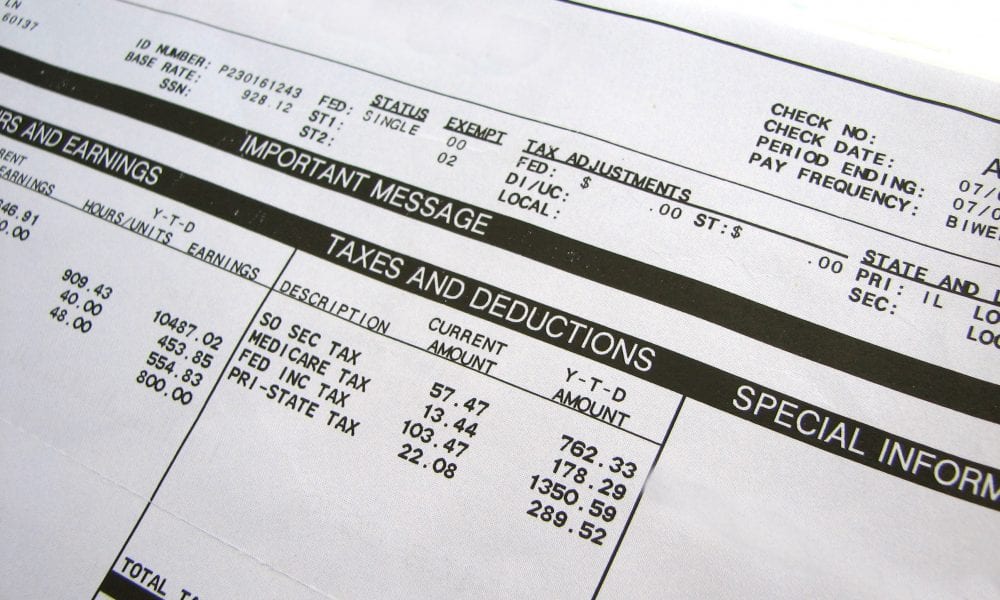

The deferral is the result of an executive order President Donald Trump issued on Aug. 8 that lets companies temporarily stop collecting the 6.2% Social Security tax that’s taken out of employee paychecks. The payroll tax deferral will last from Sept. 1 through Dec. 31, 2020, for qualified workers whose pretax wages are less than $4,000 for a biweekly pay period, including salaried workers earning less than $104,000 per year.

However, as of right now, the deferred taxes will have to be repaid. Employers will have to collect all of the deferred tax between Jan. 1 and April 30, 2021 — which means they’ll be taking double the usual amount of Social Security tax out of employee’s paychecks during that time period.

Some Companies Opt-Out Of The Tax Deferral

Trump has said he hopes to “terminate” this tax, eliminating the need for companies and their employees to pay back the deferral in 2021. But these taxes, which fund Social Security, cannot be waived without Congressional approval. Without action from Congress, that money will need to be paid back — and so far Congress seems unlikely to make the deferral permanent.

As a result, many companies have opted out of the payroll tax deferral.

Business organizations such as the U.S. Chamber of Commerce and the National Retail Foundation have also expressed concern over the tax holiday.

“If this were a suspension of the payroll tax so that employees were not forced to pay it back later, implementation would be less challenging,” the Chamber stated in an Aug. 18 letter to Congress. “But under a simple deferral, employees would be stuck with a large tax bill in 2021. Many of our members consider it unfair to employees to make a decision that would force a big tax bill on them next year.”

What If You Can’t Opt Out Of The Payroll Tax Deferral?

Not everyone’s company has the ability to opt-out of the plan. For example, federal employees and the military are obligated to participate in the deferral. In 2021, these employees will need to pay back the salary bump they’ll be seeing over the next few months.

If you can’t opt-out of the deferral, it’s a good idea to save now so you’re ready after the first of the year, financial advisor Eric Bronnenkant told the Washington Post.

“People who cannot afford the extra tax in 2021 out of normal earnings should be setting aside the extra funds received currently in a savings account to be drawn down on during the first four months of 2021 to avoid being in a position to need to fund normal life expenses with high-interest credit card debt or personal loans,” he said.