For all the parents who have ever struggled to get their kids to grasp the value of their belongings … for all the parents who don’t know quite how to explain why they can’t buy their kid yet another pair of shoes … for all the parents who have ever, in a fit of frustration, threatened to throw away all the toys that have not been put away, only to get the response, “That’s fine” — this app is for you.

Chore charts and stickers not working anymore? The folks behind the BusyKid app may have a solution. This smartphone app offers a new kind of chore chart — one that gives kids the chance to build up their financial literacy as they earn money and make decisions around saving, investing, donating to charity and spending some of that hard-earned money on the next hot doo-dad.

So, how does this app work to (hopefully) make your child grasp the value of money and, by extension, be more responsible with their decision-making around it?

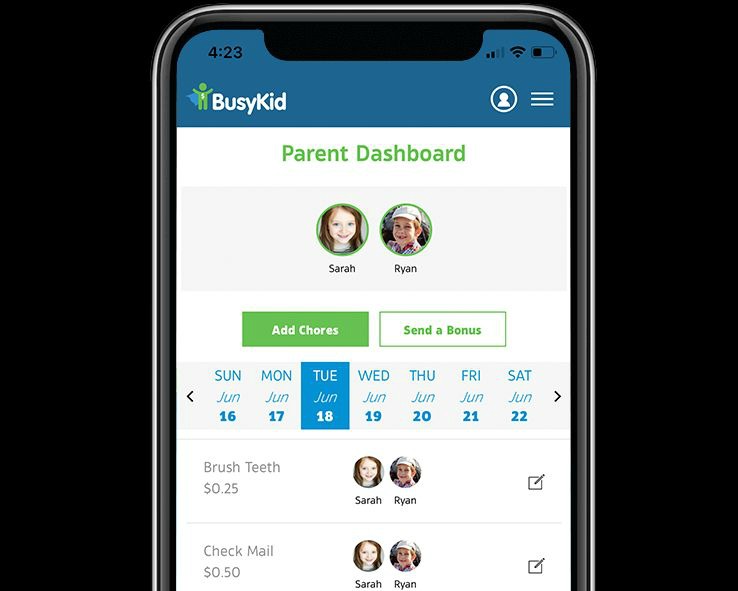

Here’s the deal: Using the Parent Dashboard, adults can assign chores to their children, giving each chore a set monetary value.

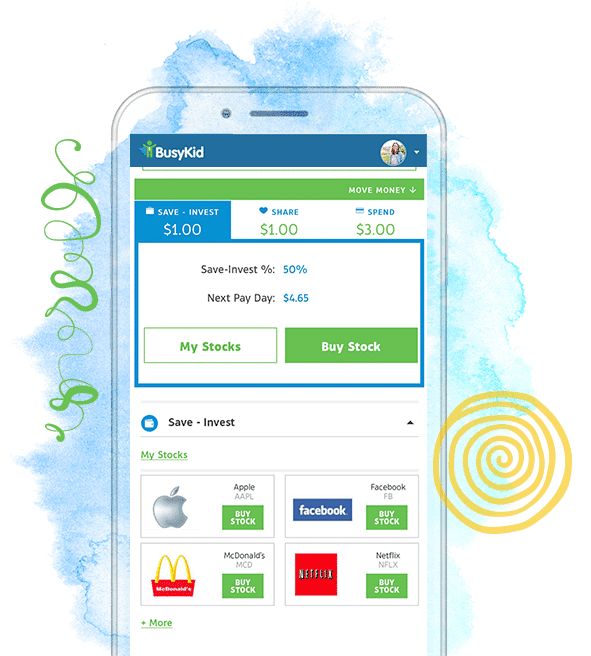

As they complete their chores and earn that sweet, sweet cash, the money can then be allocated in a number of ways. Money can be deposited into a savings account. It can be used to invest in stocks:

It can be used toward charitable donations:

And don’t worry, kids. It can also be placed onto a pre-paid Visa debit card.

These allocations are pre-set when you first sign up for the app, based upon the age of your child, but parents can change it at any time from their dashboard.

Parents can even give kids a bonus if they do something really outstanding. It’s just like having a real job, except they don’t have to worry about that darn commute!

The beauty of this system is that it can be used as a tool to teach kids about financial decision-making. According to the app’s description, it can be used to promote “work ethic, responsibility, accountability and smart money decisions.”

But this is obviously more likely to happen if you actually have a conversation with your kids about the app’s use. You’ll want to sit down with them to go over their various stock options and to discuss which of the over 20 charities they might want to support, in addition to talking about why their money is being allocated in certain ways.

The app is available for both Android and iOS, and costs $24.99 a year. Not bad for a financial app with so many options.

What do you think? Would you try this app? Or do you miss the days of ye olde chore charts and smiley-face stickers?