You take pride in being a safe driver. You never text while driving or allow other distractions to take your focus away from the road. You try to avoid speeding, slow down at yellow lights and stop for pedestrians.

Then, out of the blue, it happens. Someone rear-ends you at a stop sign, runs a red light and hits your car or causes some other type of fender bender involving you and your vehicle.

To add insult to injury, when it is time to renew your policy your car insurance provider informs you that your rates are going up significantly because you were involved in an accident. Can they even do that?

Depending on where you live, insurance companies may be allowed to carry out this practice — and often do.

The Consumer Federation of America (CFA) is an association of non-profit consumer organizations, which performs research, advocacy, education and service regarding consumer issues. The organization researched the practices of five major auto insurance providers throughout the United States and discovered that four out of five penalized innocent drivers who were hit by another car, on average.

While CFA is calling on lawmakers to prohibit what they call an unfair tactic, it is important to be aware of how this practice might affect you and how you can escape an undeserved increase on your insurance bill.

Are You at Risk?

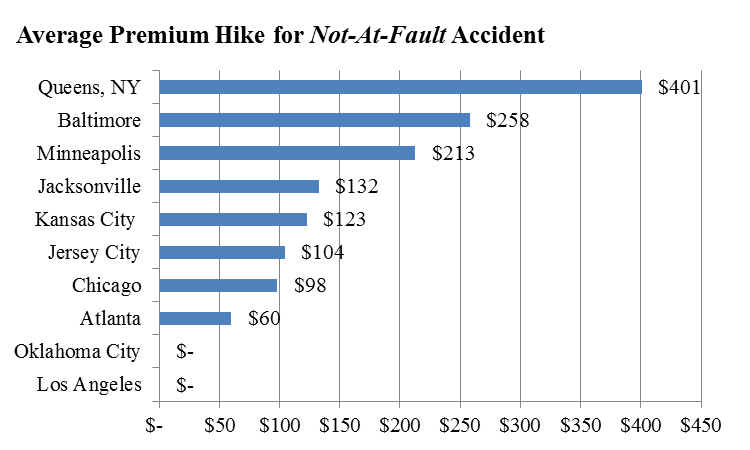

CFA research found that California and Oklahoma prevent insurance companies from raising rates on drivers involved in an accident that was not their fault. Since the organization only researched 10 U.S. cities, it is possible other states — including yours — may have similar laws as well.

However, in the remaining eight cities researched, four of the five major insurers increased rates in these circumstances to a varying degree. The cities in the study included Queens, Baltimore, Minneapolis, Jacksonville, Kansas City, Jersey City, Chicago, Atlanta, Oklahoma City and Los Angeles.

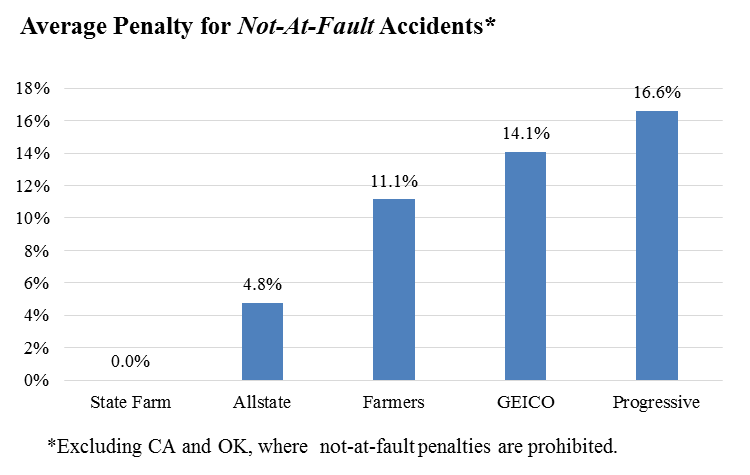

Of the five insurance companies included in the study (Allstate, Farmers, Geico, Progressive and State Farm), only State Farm never penalized drivers who did not cause the accident. Allstate did so occasionally, at an average of 4.8 percent. The remaining three insurance companies researched increased rates for drivers in not-at-fault accidents between 11.1 percent (Farmers) and 16.6 percent (Progressive), on average.

Where you live seems to matter, as well. While Atlanta residents generally saw an increase of just $60 on their premium following an accident, drivers in Queens experienced a whopping $401 rate hike.

Another premium increase factor? Income. When comparing driver with similar driving records, CFA discovered that moderate-income drivers paid an average of $208 more for insurance following a not-at-fault accident, while rates for higher-income drivers only jumped $78.

Avoiding a Premium Hike

If you view this practice as highly unfair, you are not alone.

“Innocent drivers who don’t cause accidents should not be charged more because someone else hit them,” said J. Robert Hunter, CFA’s director of insurance. “Most people know that if they cause an accident or get a ticket they could face a premium increase, but they don’t expect to be punished if a reckless driver careens into them.”

Douglas Heller, an insurance expert who helped CFA conduct the research, encourages consumers to inquire of and complain to their state insurance department about these unreasonable rate hikes.

“State leaders should at least prevent insurance companies from punishing good drivers for having the bad luck of being in the vicinity of someone else’s bad driving,” said Heller. “Diverse states such as Oklahoma and California have banned the practice. A little push from consumers could persuade other states to do the same.”

Being proactive can help you prevent an increase in the event that you are in an accident caused by someone else. Contact your insurance agent and ask about their policies regarding this practice. Inform them that you know State Farm does not penalize its customers and that you find the approach unfair. If they can’t promise it won’t happen to you, it might be time to start looking for a new auto insurance company.