You’re looking to cut back on spending, and one of the first things you decide to eliminate from your daily routine is picking up that fancy coffee drink on the way to work. Maybe you decide to cook more instead of taking the family out for dinner.

Sure, those are all great ways to start saving money and stop wasting it, but all too often we divert our attention into cutting back on the smaller things in life when we should be paying more attention to the bigger things, like cars and housing.

Figuring out how you’re spending your money (or wasting it) on some of the bigger expenses in life is likely where you can actually save the most.

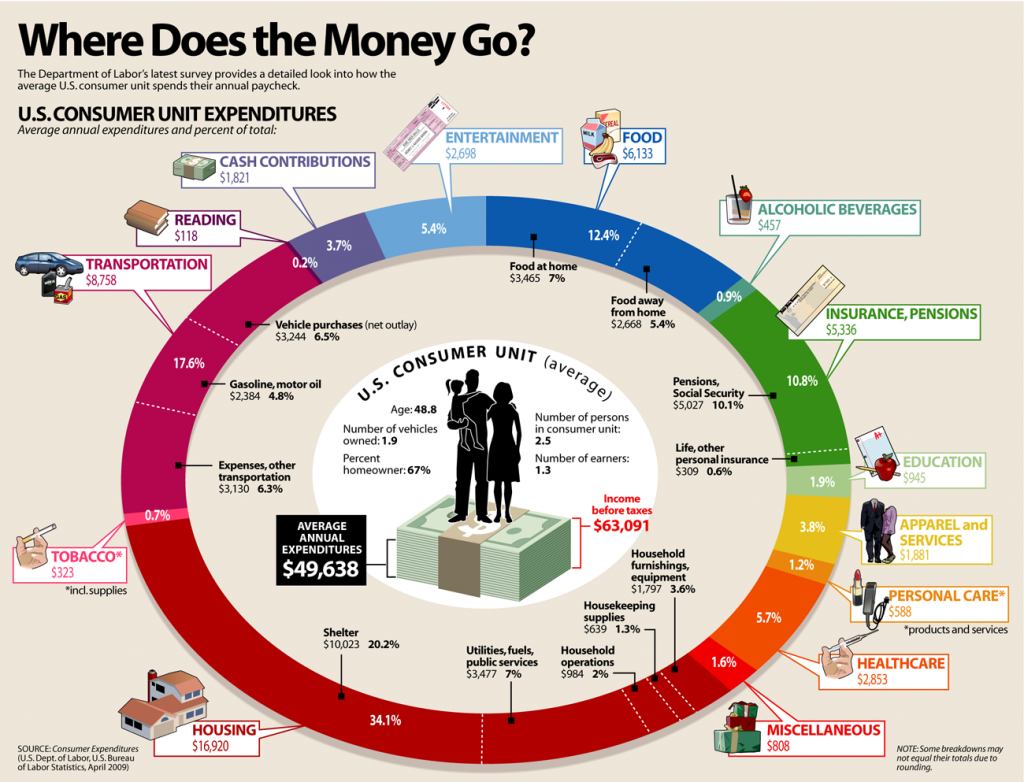

This graphic from the U.S. Department of Labor shows how the average U.S. household spends their money.

It’s no surprise that housing comes in as the biggest expense, followed by transportation and then food.

These numbers have changed a bit since this graphic was created, but the proportions are still roughly the same.

So the question really comes down to, how can you save in the three areas where you spend the most money to ensure you’re not wasting it?

Here are some ideas, broken down into category:

Housing

Costs: According to the most recent labor department data, consumers spend 32.9 percent of their income on housing. Housing and what it costs to run your home is reportedly the biggest expense for most households and there’s a lot of things that factor into that cost.

From your location, the cost of your home, your rent or mortgage payment to the money it takes to maintain your home, there are a lot of contributing factors. This handy Cost of Living Calculator might help you decide if where you’re living is your best choice financially.

Ways to save: Check out what it costs to live in other areas of your city. Maybe just taking the plunge and moving to a suburb that’s a little less expensive could end up saving you thousands.

If you own, it might be worth your while to shop around for a lower mortgage rate or term. Even a seemingly small change to your interest rate can help you save thousands of dollars.

If you’re a renter, try negotiating the cost of your monthly payment when it’s time to resign your lease.

Transportation

Costs: For most, transportation is the second largest expense and that includes everything from the cost of your car, maintenance, gas and how much you drive on a daily basis. It accounts for more than 17 percent of our spending.

Ways to save: Living closer to work is one way to help reduce the cost of transportation. It’s reported that for every mile you live closer to work, the better.

Lifehacker broke down some data and reported that each mile you live away from work costs about $795 in commuting expenses. Now that is a lot of money!

The average household typically has two cars. If there’s anyway you can eliminate the need for a second car, you’ll end up saving thousands.

Food

Costs: Food is yet another big expense, but thankfully, there are hundreds of ways you can get creative to save some serious money. It really comes down to changing your habits from where you dine out to how often and what you order. By changing a few simple things, you could end up saving yourself quite a chunk of money. Food accounts for more than 12 percent of our spending, according to the most recent data.

The same goes for grocery shopping. Getting in the habit of meal planning and preparing meals ahead of time can also be beneficial for your budget.

Ways to save: Spend less when eating out. Eating less by not going to a restaurant super hungry, using coupons and changing what restaurants you dine at can all be great ways to save a little while still enjoying a meal out.

Meal planning is also a great way to save money plus you’ll always know what’s for dinner.

And hey, if you’re looking for a creative way to save money, you could even try bartering on Craigslist.

Studying how your money is being spent can then put you in the position to figure out ways to start saving. While I’ve only covered ways to save on life’s biggest expenses, living an overall frugal lifestyle can only benefit you in more ways than one.