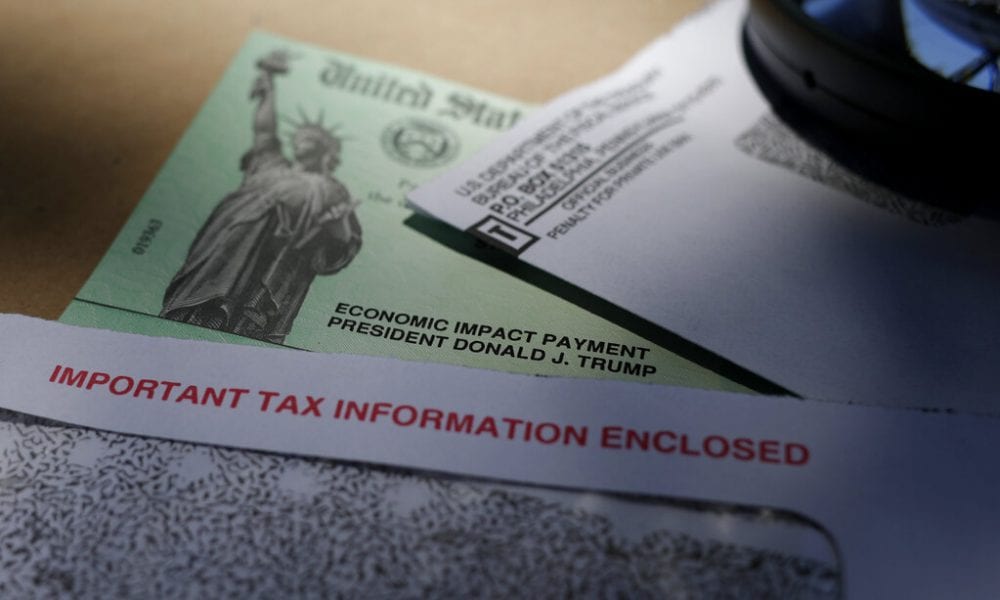

Did you know that both rounds of stimulus checks the government has issued are actually advances on a temporary 2020 tax credit? But because of the financial duress the coronavirus has caused, the federal government needed to find a way to get the payments out quickly as Americans have lost jobs, struggled to make ends meet and dealt with financial anxiety amid a pandemic-induced recession.

Because 2020 tax returns are not yet due, the IRS used 2019 (and in some cases 2018) returns to determine eligibility for stimulus payments. While this helped the government issue the checks more efficiently, those past tax returns may not accurately reflect your financial situation in 2020. It’s possible that recent life changes have changed your tax situation, which could mean you qualify for more stimulus money that you can recoup with your tax return this year.

Here are a few common scenarios that could qualify you for more stimulus money come tax time:

You Never Received A Stimulus Payment

The federal government has begun sending out the second round of stimulus payments, providing $600 to each eligible adult and child, and the Internal Revenue Service has until Jan. 15 to issue these payments.

But if you don’t receive this second payment (millions of the payments are missing or delayed because they were sent to closed bank accounts) you could qualify for a Recovery Rebate Credit on your 2020 tax return and the money will be issued as part of your regular refund.

Also, if you didn’t get a stimulus payment during the first round of stimulus payments, which began arriving in April 2020, or you didn’t get the full amount of your first stimulus payment, you might qualify for a rebate credit. (More below on how your changing income situation could affect your stimulus payments.)

The rebate credit is on line 30 of the 2020 Form 1040 or 1040-SR, according to the IRS.

Your Income Decreased

From layoffs to furloughs, the economic fallout of the coronavirus pandemic has been widespread. In fact, one quarter of U.S. adults say they or someone in their household was laid off or lost their job because of the coronavirus pandemic, according to a September 2020 report from the Pew Research Center. Also, with schools shut down, nearly 1 million married women dropped out of the workforce in the month of September and coinciding with the back-to-school season, accelerating a “female recession.”

Again because stimulus payments were doled out based on information from 2018 and 2019 tax returns, if your income has decreased in 2020, you could qualify for larger stimulus payments.

As an example, individuals who made up to $87,000 qualify to receive payments from the second round of the stimulus payments. (Those who earn up to $75,000 get the full $600, then, from there, the checks are reduced by $50 for every $1,000 exceeding the phaseout threshold, CNBC Make It explains). But let’s say you earned $90,000 in 2019, and then lost your job or clients in 2020, and your income dropped below $75,000. While the IRS wouldn’t have automatically sent you $600 in this second round of payments, you can qualify for the payment with your 2020 return.

A calculator like this one could help you determine your eligibility for stimulus payments based on your 2020 financial picture.

You Had A Child In 2019 Or 2020

If you had a baby or adopted a child in 2020, you could qualify for an additional $1,100, according to Nasdaq. The automatic payments were generated from prior years returns, so the IRS wouldn’t have known about the new addition to your family. The extra $1,100 you could qualify for via the refund recovery credit includes $500 from the first round of stimulus payments and $600 for the second round of payments for dependent children 16 and younger.

Also, if you had a child in 2019 but took advantage of the coronavirus tax extension and filed your 2019 taxes later in the year, the IRS likely used your 2018 return to process your stimulus check so you would also be eligible for up to an extra $1,100.

Also, if you increased your retirement contributions or you were claimed as a dependent on 2019 tax returns, but not 2020 returns, you may qualify for more stimulus money with your 2020 tax return, according to The Penny Hoarder.

Before filing your 2020 taxes, it’s worth checking with your tax professional to see if there are any scenarios in which you might qualify for more stimulus money.