Guys, this is a little embarrassing.

As it turns out, Americans are really bad with money. New data from GOBankingRates may help explain why.

They conducted a survey to see how familiar people were with common financial terms. The result? Roughly one in three Americans had no clue what these financial terms meant.

Here are the questions they asked:

- Which of the following describes a 401(k)?

- What does a CD offered by a bank stand for?

- What is net worth?

- What does HELOC stand for?

- What are the three major credit bureaus?

As the survey findings show, maybe we all need a quick refresher on some common finance terms.

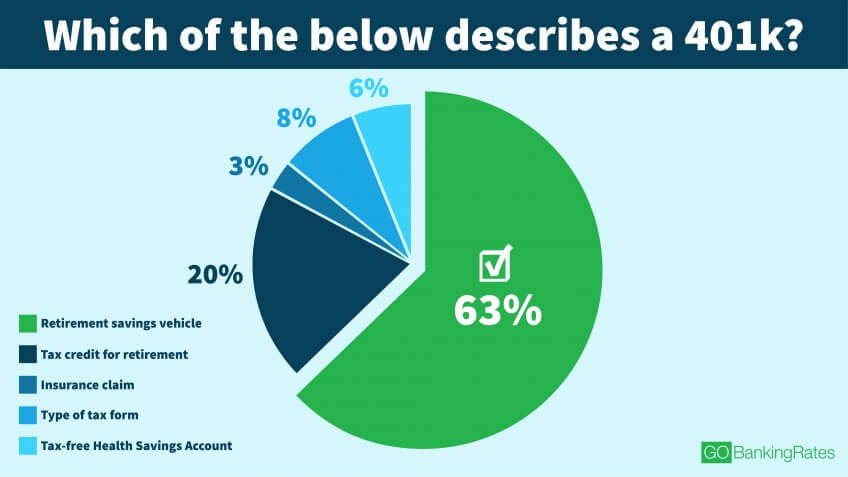

1. What’s a 401(k)?

What it is: 63 percent of respondents correctly identified a 401(k) as a retirement savings vehicle. A 401(k) has to be offered by your employer and it allows you to save money before taxes get taken out of your paycheck, which is a nifty bonus that can lower your overall amount of taxable income.

What it isn’t: 37 percent of respondents incorrectly thought it was a tax credit for retirement, an insurance claim, a tax form or a tax-free health savings account.

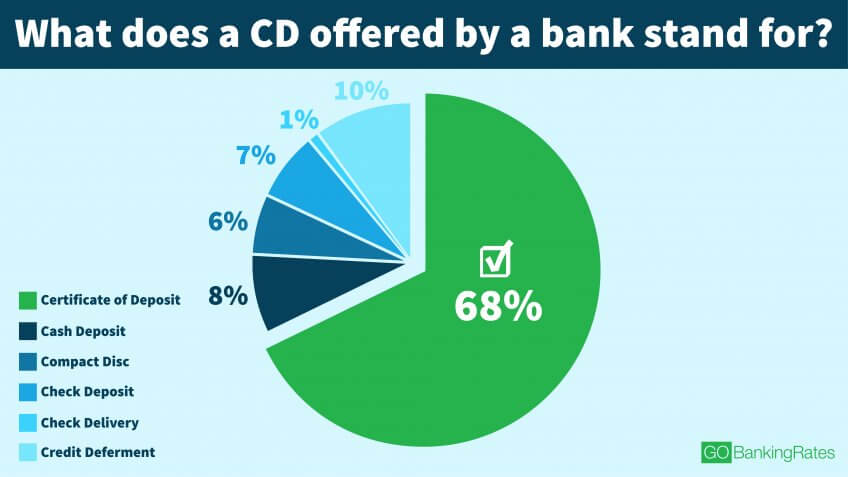

2. What is a CD?

What it is: 68 percent of respondents correctly identified a CD as Certificate of Deposit. A CD is a bank account that tends to offer a higher annual percentage yield, which means you’ll be earning more while the money sits in the account (without lifting a finger!).

What it isn’t: 32 percent of respondents thought a CD was a cash deposit, a compact disc, a check deposit, a check delivery or a check deferment.

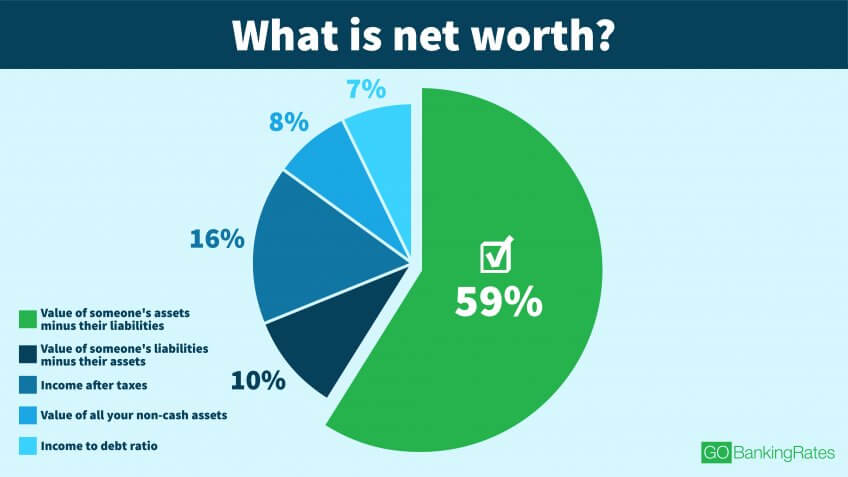

3. What is net worth?

What it is: 59 percent of people correctly identified net worth as the value of someone’s assets minus their liabilities. In other words, all the money and stuff you own, minus all the debts you owe. Think of it like a balance sheet for a business.

What it isn’t: 41 percent of respondents thought that net worth was your income after taxes, value of all your non-cash assets, income to debt ratio and the value of someone’s liabilities minus their assets.

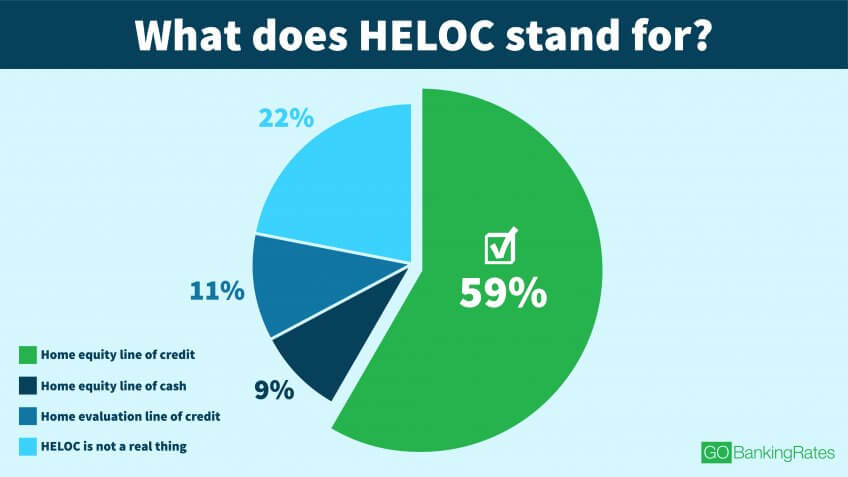

4. What is a HELOC?

What it is: 59 percent of respondents correctly identified a HELOC as a home equity line of credit, which is a secured line of credit backed by the equity in your house. Unlike a home equity loan (also known as a second mortgage), you don’t have to take on lump-sum with a HELOC—once you’re approved, you can use it as needed for a certain period of time, much like a credit card.

What it isn’t: 41 percent of respondents incorrectly thought it was a home equity line of cash, home evaluation line of credit or not a real thing.

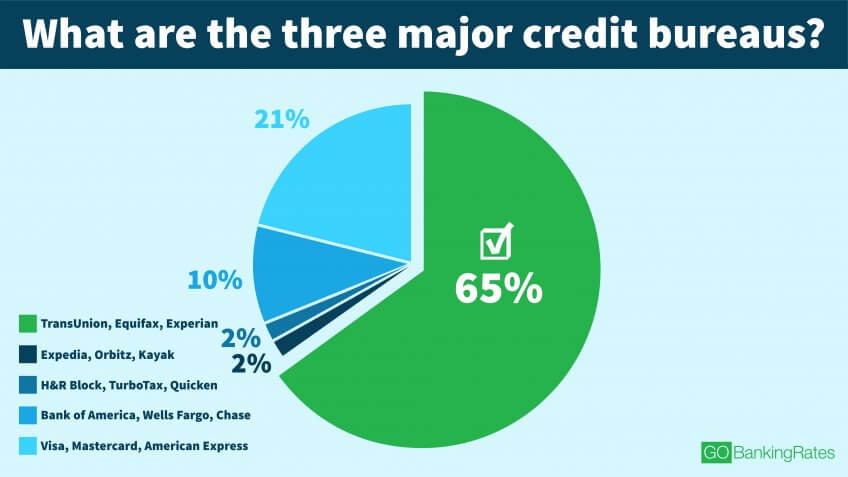

5. What are the three major credit bureaus?

What it is: 65 percent of respondents correctly answered TransUnion, Equifax and Experian. These credit bureaus are for-profit companies that collect information on your credit history and then sell it to you, banks, car dealerships—basically anywhere you’re trying to get a loan.

You don’t need to pay these credit bureaus to see your credit report. You can check your credit report once a year on each site FOR FREE. This is a good idea, because it can give you a head start on attempted identity theft, incorrect information about your accounts and other factors that could hurt your credit.

What do you think? Which financial terms took you the longest to grasp? And are you doing anything to help educate your kids about personal finance? Let us know!