If you’re a Starbucks lover—and we mean seriously obsessed—a new credit card from the coffee company and Chase may be just the thing for you.

It’s not for the occasional frappuccino drinker by any means, but if a trip to Starbucks is a daily thing for you, it’s definitely worth looking into.

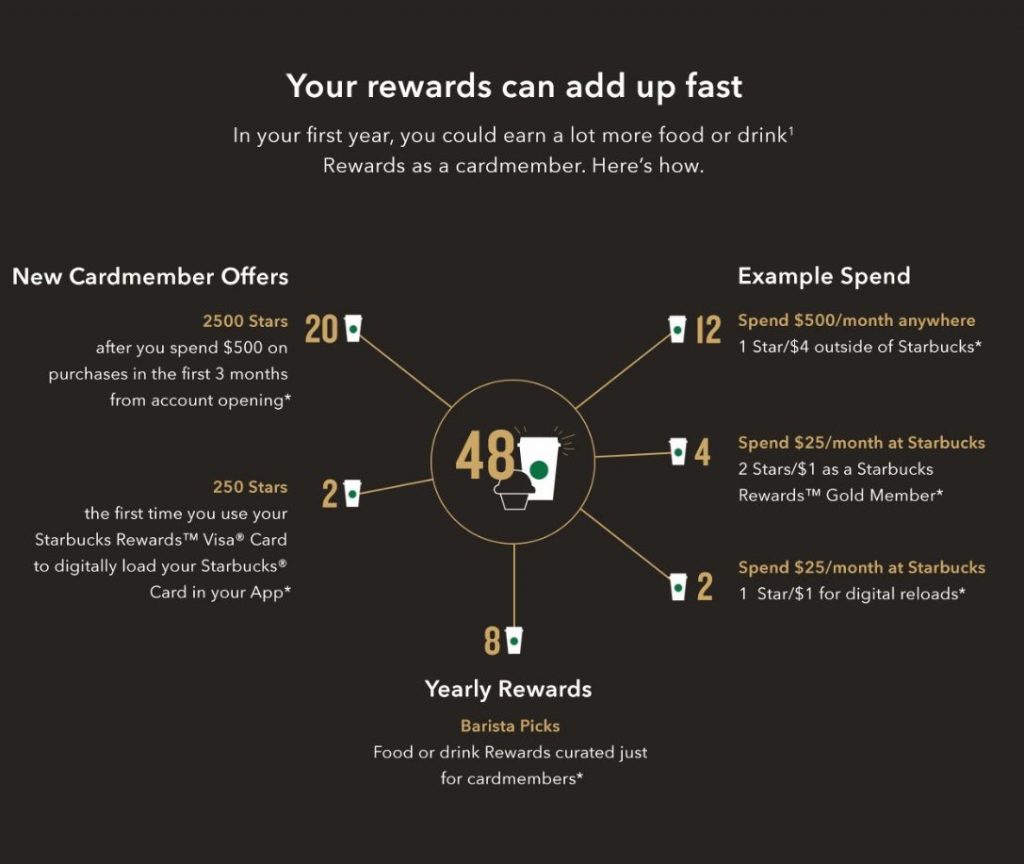

Customers using the card will earn “stars” for every purchase, both in and out of Starbucks locations, wherever you can use Visa. Those stars can then be redeemed for food and beverages at the coffee shop.

Yes, that means the pair of boots you just bought not only make your feet look amazing, but they also got you closer to a caffeine buzz.

Cardholders will also become members of the Starbucks Rewards loyalty program, which will give you other perks and benefits as well. (Quick note though, you can totally sign up for the rewards program for free without the credit card. Just click here.)

With the card, you’ll get 2,500 stars after spending $500 on purchases in the first three months after opening the account, which is equal to 20 food or beverage items. After that, you’ll receive one star for every $4 spent outside of Starbucks stores, up to three stars for every $1 you spend at Starbucks stores and a few other benefits.

You should know that there is a $49 annual fee for the card, so you are paying for all these rewards points. For more information on the pricing and terms of the card, click here.

Is The Starbucks Credit Card Right For You?

While the promise of remaining caffeinated for all eternity may sound tempting, is it worth opening up a credit card for the promise of some free jolts of energy?

There are pros—like rewards and getting something without having to pay right that second—and cons to opening credit cards, so it’s best to look at all the details before deciding. Be sure you really want any credit card you open, as canceling a credit card later can hurt your credit score, as can having too many credit cards with high balances.

It’s also important to remember to pay your credit card bill on time, because if you don’t, you’ll end up paying interest on your purchases. According to NerdWallet, if you don’t think you’ll be able to pay your bill on time, you should apply for a credit card with a 0 percent introductory APR to give you time to pay it off without getting charged more. (FYI: the Starbucks card has an APR of 17.24 percent to 24.24 percent).

If you’ve determined a Starbucks credit card is worth it for you, click here to apply.