The products and services mentioned below were selected independent of sales and advertising. However, Don't Waste Your Money may receive a small commission from the purchase of any products or services through an affiliate link to the retailer's website.

Have you ever wondered how the wealthy live?

And perhaps more importantly, what they are doing with all their money?

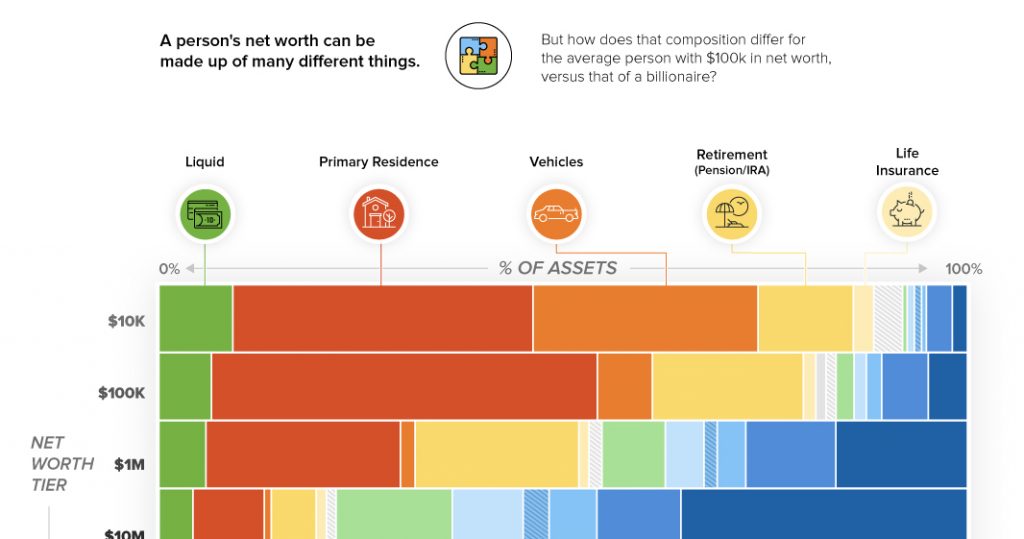

This chart below from Visual Capitalist breaks down how people of different net worth tiers (from $10,000 up to $1 billion) keep their assets.

A person’s net worth is calculated using a number of factors, including liquid cash, stocks, real estate and cars.

Net worth is the sum of all a person’s assets after subtracting any liabilities (like loans). But exactly how a person’s money is distributed differs based on how wealthy they are.

The chart was created by Visual Capitalist using data from the Federal Reserve Survey of Consumer Finances from 2016.

So what does this data show? There are a few major takeaways.

Do As The Wealthy Do

For all net worth tiers up to $1 million, a person’s primary residence accounts for the largest asset class. This makes sense. If you look at the homeowners you know, their home is probably the most valuable thing they have.

Perhaps not surprisingly, stocks become a bigger proportion of a person’s wealth as you move up the tiers. After all, the less money you have, the less you will have to invest, and the more likely your money will be tied up in things that are useful to you now, like your home and vehicles.

While a lot of us would like more cold, hard cash, when it comes to the ultra-wealthy, a lot of their money is not liquid. Instead, their wealth lies largely in business interests.

So is there anything those of us who don’t fall into the upper net worth tiers can learn from this chart? Yes.

You might be surprised to see that the wealthier people are, the less of their net worth comes from their primary residence.

In other words, as people become wealthier, they aren’t going out and buying a more expensive house. They’re putting that extra wealth elsewhere. Their home doesn’t represent such a huge proportion of their assets.

In addition, wealthy people have learned that it’s not advantageous to be “house poor.” According to Tom Corley, a certified financial planner and author of “Rich Habits – The Daily Success Habits of Wealthy Individuals,” those with a net worth of $3.2 million or more spend just 25 percent of their monthly income on housing and 10 percent or less on entertainment.

Similarly, it may be shocking to see that the money tied up in vehicles all but disappears when you reach the wealthiest tiers. That’s because cars quickly depreciate in value, and wealthy people choose to invest their money in assets that will retain or increase in value over time.