How I Ended Up With $110,000 Of Debt—And What I’m Doing To Pay It Off

I remember the moment my debt first terrified me. The deferment period was over on my grad school student loans and I had just received the first bill in the mail. I was staring $60,000 in the face with no idea how I was going to pay it off. But to understand why a “normal” amount of student loan debt paralyzed me with fear, I have to back up and tell the rest of the story.

I didn’t grow up in a home where debt was normal. My parents buy their cars with cash, they pay their credit cards in full every month and they own five homes, mortgage free. The battle cry in our home was, “Never, ever, EVER carry a balance on your credit card.” Yet once I got to college and started receiving enticing credit card offers in the mail — I could have a pink one with flowers on it! — I was a goner.

For the first few months, I did as my parents said and paid my bill in full. I remember feeling so smug that I was going to be the rare responsible college kid who left school without a pile of debt. After all, my parents paid my college tuition, so what kind of trouble could I really get into? A lot, apparently. By the time I received my bachelor’s degree, I was nearing $10,000 in credit card debt. How does this happen? A combination of a bank deciding a college student with no income “needs” a $17,000 credit line and a college student thinking she “needs” tickets to every concert that comes to town. It was a perfect storm.

Shortly after college, I was accepted into Northwestern University’s Medill School of Journalism graduate program. I was elated. I saw the price tag — a cool $60,000 — but the price didn’t matter. It was the opportunity of a lifetime. At this point in the story I want to take a moment to say that if given the choice again, I would 100 percent repeat my decision to go to graduate school. I made lifelong friends, incredible connections and I met my husband. Graduate school was the right choice for me, but it’s not for everyone.

My parents told me they would pay for undergraduate, but grad school was up to me. Fine, I said, no problem. I’ll figure it out. The problem was that I had no idea how student loans work. Does anyone really know how student loans work before they sign on the dotted line? Does anyone really know how they work even after they’ve paid them back? The excitement of going to school masks all the words on those papers that tell you the steep interest rates and if you’re lucky you’ll repay these loans before your 50th birthday.

At the end of 2012, I received my master’s degree and I was officially $110,000 in debt. That’s $60,000 in student loan debt and, yes, $50,000 in credit card debt. So, back to where I began this story.

Living With Debt

After grad school, I worked at a rural lifestyle magazine in Kansas. The job paid $35,000 per year, which was more than my friends were making at the time. Living expenses are low in Kansas, so without my debt I actually would have been in a pretty good position. Unfortunately, I could barely afford my electricity bill even before my student loan balance arrived in the mail. I remember feeling ice cold shock and I had trouble breathing. There were weeks I wasn’t sure how I was going to afford food. I didn’t turn the heat on in my apartment during the frigid Kansas winter. I regularly put $10 worth of gas into my car and hoped it would last me until my next paycheck. Thank goodness for carpooling because there was no way I could have afforded gas to work and back every day.

Honestly, I had no idea how much debt I actually had. I knew it was a lot. But I refused to confront the balances until one afternoon I was crying in my kitchen about the shame and fear I felt. My parents had repeatedly asked me over the years if I had credit card debt. I lied and said no. I hated to lie to them. I wish I had asked for their help long before this. But this was my life and I needed to figure it out.

I made a list of all my balances and, after a good long cry, called the credit card companies to ask for a reduction in interest rates. To my surprise and relief, Chase offered me a hardship plan. Here’s how it worked: For 60 months I would pay the exact same amount at 2 percent interest until the balance was paid. If there was anything left after 60 months, Chase would forgive the balance. The catch is that the cards would be closed immediately and if I missed or was late on two consecutive payments, I would be kicked out of the program and left to deal with it by myself. I signed up immediately and felt the beginnings of what would become my debt-free story.

Hardship programs are not the same as credit counseling programs. Hardship programs are offered by the bank, while credit counseling is offered by a third party. These lesser-known programs aren’t advertised by the bank, but here’s how I qualified. I called Chase and asked to speak with someone about reducing my interest rate. I was transferred to a different department where I was asked a variety of questions: what was my income, what were my monthly payments, what was my rent, what were my other expenses, such as my student loan and other credit cards. After the series of questions, the woman on the phone told me about the hardship program and explained the terms.

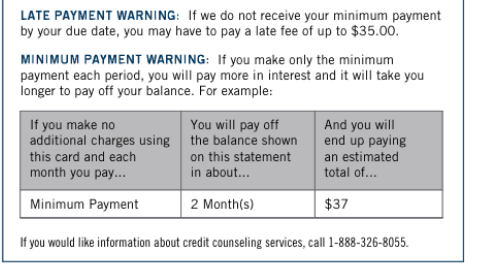

Since this was many years ago I don’t remember every detail about the program, but some say that in order to qualify you need to be delinquent on payments. If you look on your credit card statement you may see a phone number different from the general customer service number. In some cases this is the phone number to access the hardship program, but in others it’s for credit counseling. Either way, it’s worth a call to find out more information. Here’s an example of where to find it on a credit card statement:

One thing to keep in mind is that if you do enter the hardship program, you will not be able to apply for a loan or credit card with that bank for a good long while. Once you’re in the program your good relationship with the bank is effectively severed until you graduate from the program.

Paying It Off

I finally opened up to my parents about my credit card debt. After a raw and emotional conversation about my secret debt, they helped me devise a plan. My parents very generously paid half of my student loan debt and they gave me some money for an emergency fund. I asked for Dave Ramsey’s Financial Peace University for my 25th birthday.

That was almost five years ago and here’s where I stand: I have $20,000 left to pay on my student loan and I am proud to say that I am free of credit card debt. I completed the Chase hardship program in 2017, a full year early. My husband and I recently took our honeymoon, which is where we chose to make the final payment on the remainder of the outstanding credit card debt. I cannot describe the pure joy I felt making that final credit card payment. That evening we drank champagne and talked about our future rather than the past.

So, how did I pay off my debt?

Here’s an excerpt from my interview with Newsy’s “The Day Ahead,” in which I speak about all of the different side jobs I took to help pay down my debt and the importance of finding the right support system:

I’m part of the Instagram community called #DebtFreeCommunity (follow me @DebtFreeBy30!) and the question people ask me most often is, “What’s your side hustle and how do I get one?” The truth is that I’m addicted to side hustles. If you’re not familiar, a side hustle is work outside of your regular full-time job. I love my bimonthly paycheck from my job, but I’m like a kid on Christmas morning when I get paid for this extra work. So I’m going to give you my master list of side jobs I’ve done over the years to help earn some extra income and pay down debt:

- Waitressing

- Cleaning a preschool after hours

- Babysitting, babysitting, babysitting

- Gardening/picking weeds

- Helping people pack and move

- Farm sitting, house sitting, pet sitting

- Ghostwriting

- Writing blogs

- Writing articles

- Writing product descriptions for a food service supply company

- Writing apartment descriptions for an apartment finder website

- Website consulting

- SEO consulting

- Editing resumes

- Editing books, articles, blogs, etc.

- Tutoring

- Public speaking

- Filling out class-action lawsuit forms

… I think that’s all of them! Each month I aim to earn an additional 50 percent of my income through extra work. Up until this month, these payments have gone directly to debt. There’s a special type of pain that comes with receiving a beautiful $2,100 check and then immediately saying goodbye to it to pay back your past. I’m anxiously awaiting some checks in the mail so I can make my very first contribution to our savings account. And when I say anxious I mean I run out to the mailbox every afternoon like a kid waiting on a letter from their pen pal.

Looking Toward The Future

I’ve spent so many years repaying my past rather than dreaming about my future that in many ways I feel like I was held back in school. I’m turning 30 this year and this is the first time I can entertain the idea of buying a home. While many of my friends have bought and sold multiple homes at this point, I was never in that position. My adult life took a little longer to get started partly due to my self-inflicted debt isolation. I got married at age 29, older than most of my friends, and my husband and I are just beginning to talk about homeownership.

It’s easy to sit here and mourn what my life could have looked like without the debt. Would we already own a home? Would we already have kids? Would we have a ton of money in our retirement savings? Would we drive newer cars? These questions do creep up in my mind from time to time, but I’m a strong believer that we each have our own path we were meant to follow. Debt was my path, and I hope to one day understand its purpose.

Find Your Tribe

Living with debt and paying it off can feel isolating. I felt alone for so many years. Last year I took to Instagram to see if I could find anyone else in the same debt-laden predicament. I was shocked and pleased to find thousands of others on a debt-free journey. I created a new account jumped in.

This community of people on the same debt-free mission has been one of my biggest keys to success. Surrounding yourself with people working toward the same goal is encouraging, motivating and helps keep you accountable.

I know we all think that debt is normal and everyone has it, but that’s not the legacy I want for my family. My debt-free journey is about more than paying off balances so we have more money in the bank.

For me, it’s about being a living example of how debt can strain your family and stunt your personal growth. But it’s also about discovering that debt can be a season of life if we so choose. We don’t have to be in debt forever. We can hustle and sweat and work ourselves to exhaustion to get rid of it and be free. It’s about being able to turn around to see where we’ve been and look forward to how much we can grow.

More than anything, I hope my story resonates with someone, somewhere who is buried in debt and feels completely alone. You are not alone. You can do this. You are going to be OK. Face your debt, find your tribe to support you, and get mad at your debt. In not so long this will all be in the rearview mirror.