Financial and budgeting issues are often near the top of the New Year’s resolution list. We all say we’re going to be better about something this year: cooking more and eating out less, paying off our credit card debt, cutting down on online shopping, or whatever your personal money challenge might be.

So instead of setting ourselves up for disappointment when we inevitably lapse and buy our entire Kindle reading list or splurge on some really good sushi, let’s aim for a more realistic goal for the year: Stop lying to yourself.

We’re all guilty of it—those little fibs we tell ourselves to keep from panicking over our credit card statements. In this era of fake news and emails from fraudulent Nigerian princes, though, honesty is more important than ever. So let’s try just being honest about our dollars and cents, starting with cutting these 10 money lies out of our lives.

1. If I just don’t look at my finances, they’ll work themselves out.

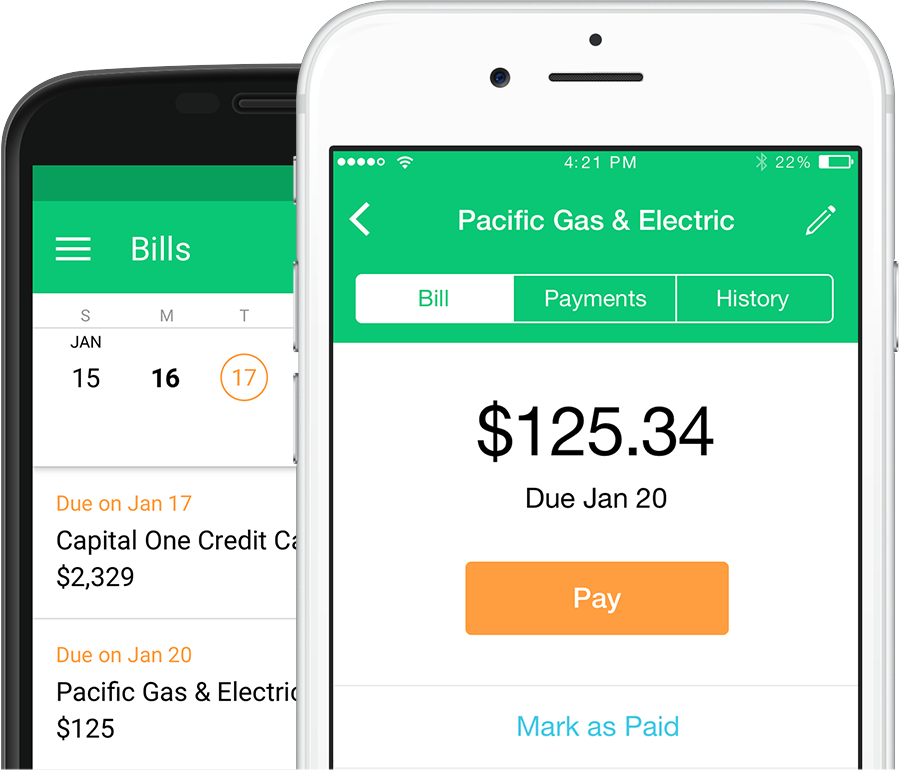

Ah yes, the famous ostrich-at-the-bank trick. Get your head out of the sand, sign up for a financial tracking app like Mint and stop avoiding your checking account balance like it has the flu. No matter how painful it is right now, it’ll be way worse later when you get hit with an overdraft fee or your credit score tanks, all because you didn’t bother to check in on your accounts on the regular.

2. I got approved for this credit, so I can totally handle it.

Getting approved for a credit card is easy—credit card companies love taking your money! Managing that credit card and ensuing debt is harder, though. Getting a new credit card is not necessarily a wise choice, especially if you’re already struggling to pay off existing debt.

The same goes for increasing your credit line. This is usually a sign that you’ve been doing a good job managing your exiting credit, but don’t let the new limit go to your head. Keep spending the way you’ve been spending, stay well within your means and don’t fall into the lifestyle inflation trap.

3. It doesn’t matter if I hate my job, as long as I’m getting paid.

Sure, having a job is better than having no job, but if work is making your life miserable, you may want to reconsider that whole work-life balance thing. Financial security is important, but not at the cost of your sanity. If your job has you stressed, exhausted or just plain burnt-out, you shouldn’t feel like a failure for wanting a change. This doesn’t mean you should quit your job tomorrow to travel the world, but it’s possible to find a happy medium that lets you pay your bills without ruining your life.

4. I should buy a house/get married because that’s the next step.

Even if you’re totally in love with your partner/that cute house you saw yesterday, marriage and buying a house are both major life decisions with equally major financial implications. You don’t want to start your life together buried under massive debt, or have no money left over to live after your down payment. It’s better to wait until you’re financially secure instead of adding financial stress into your life to keep up with the Joneses.

5. I don’t have enough money to start investing.

Did you buy coffee this morning? Or order takeout last week? Great, you’ve got enough money to start investing!

Opening an investment account can seem really intimidating, especially if you’re not a high roller. But retirement and other investment accounts are for regular people, just like you and me. The trick is, the sooner you start putting money into them, the sooner they start working for you. It doesn’t have to be a lot of money—even if you choose to invest just $10 a week, you’d have $3,295 after just five years (with an average 8 percent return).